A loss of trust in the technology hub’s ability to protect intellectual property could threaten its economic survival.

By Tim Culpan

An article of faith.

An article of faith.

A U.S. indictment of United Microelectronics Corp. and three executives is a slap in the face for Taiwan.

As a critical partner in the nexus between U.S. clients and the Chinese supply chain, the last thing Taiwan needs right now is to become known as a place that can’t be trusted.

This isn’t the first time its credibility has come into focus.

Weak enforcement is endemic in Taiwan, from insider trading rules to know-your-customer requirements, and that includes many more cases of intellectual property theft.

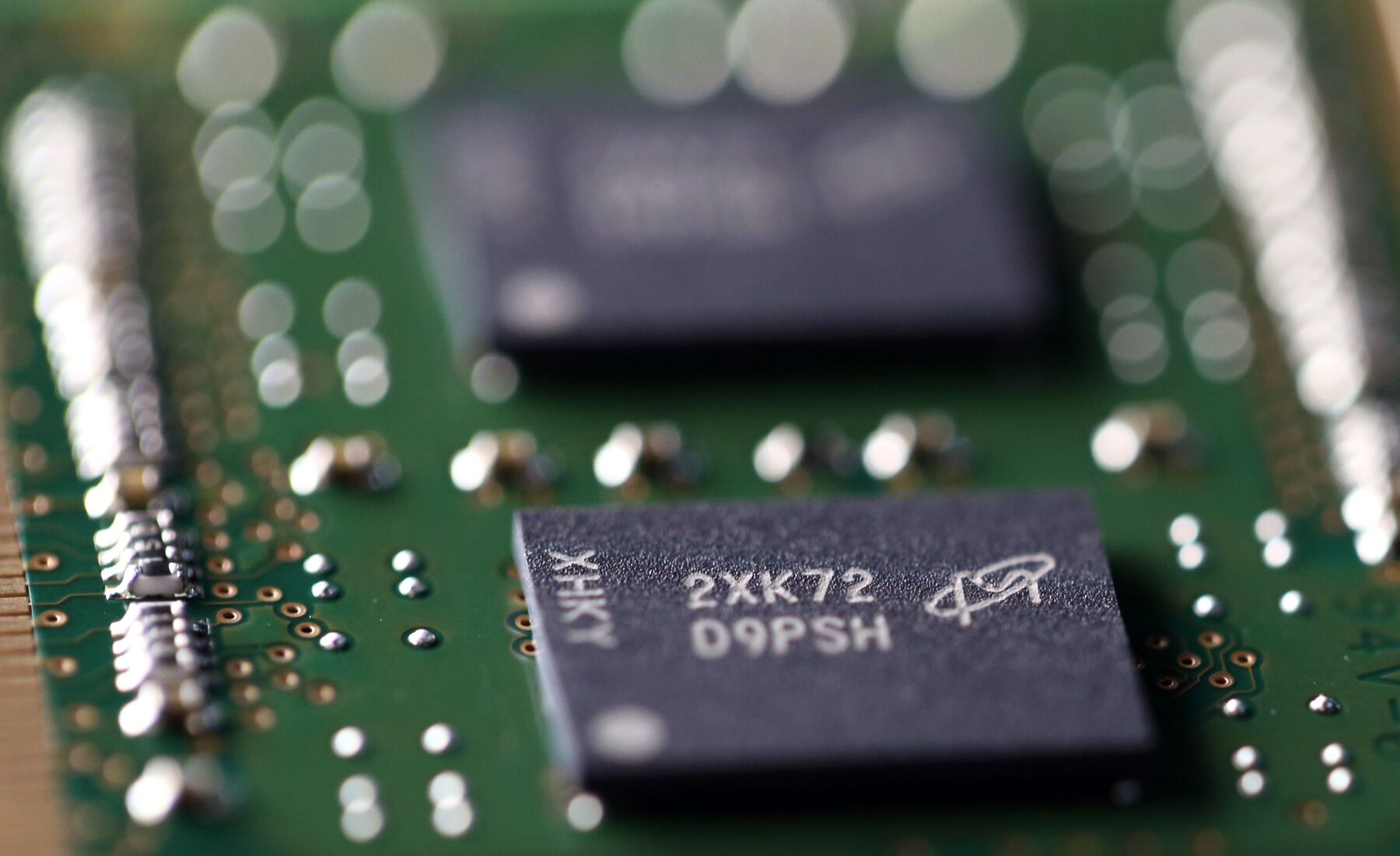

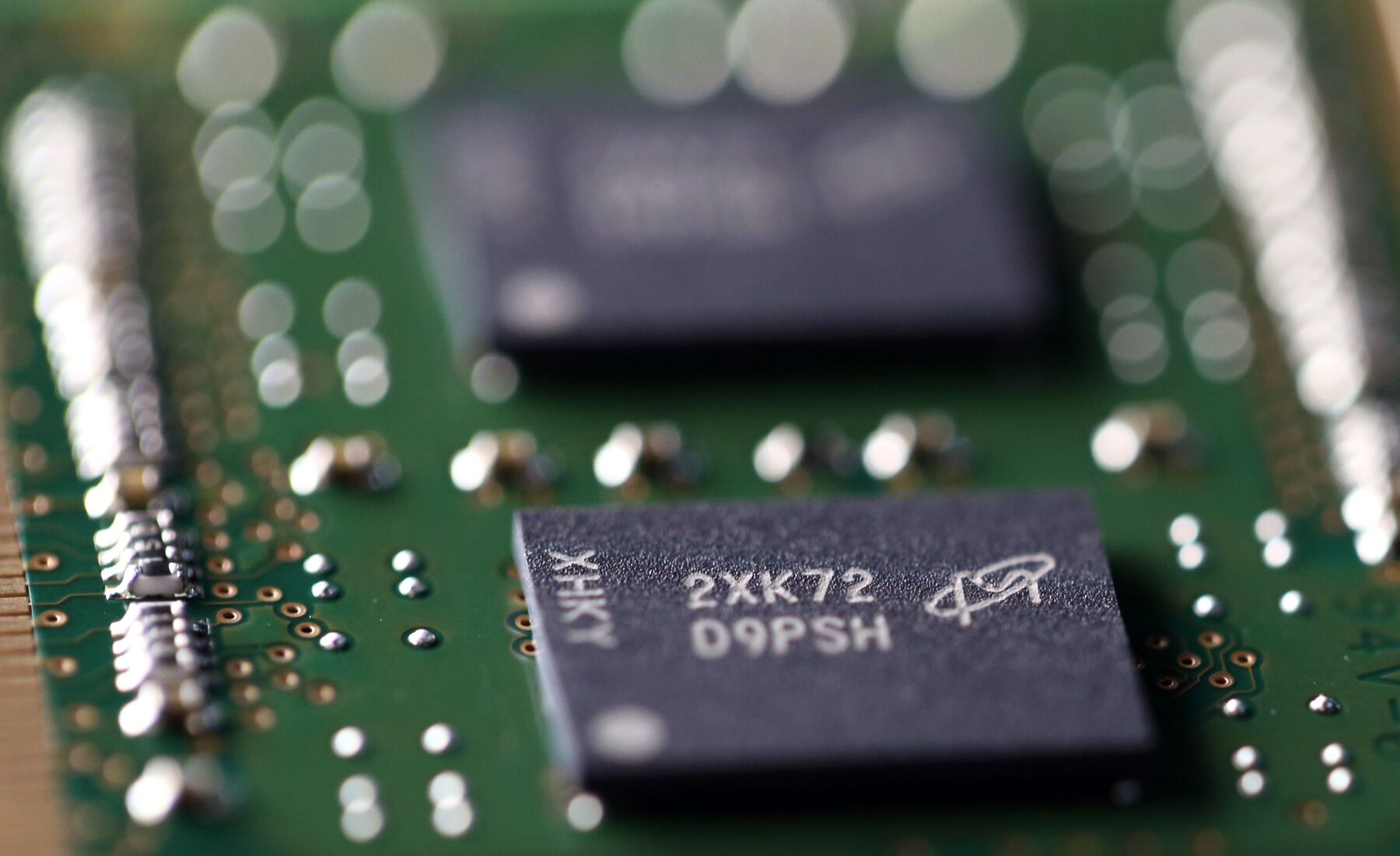

According to the U.S. Justice Department, UMC executives were the front for a Chinese plan to steal semiconductor secrets from Boise, Idaho-based Micron Technology Inc.

An article of faith.

An article of faith. A U.S. indictment of United Microelectronics Corp. and three executives is a slap in the face for Taiwan.

As a critical partner in the nexus between U.S. clients and the Chinese supply chain, the last thing Taiwan needs right now is to become known as a place that can’t be trusted.

This isn’t the first time its credibility has come into focus.

Weak enforcement is endemic in Taiwan, from insider trading rules to know-your-customer requirements, and that includes many more cases of intellectual property theft.

According to the U.S. Justice Department, UMC executives were the front for a Chinese plan to steal semiconductor secrets from Boise, Idaho-based Micron Technology Inc.

Even before jumping into bed with state-owned Fujian Jinhua Integrated Circuit Co., UMC had a history of questionable deals in China.

More than a decade ago, the Hsinchu-based company was charged with illegally investing in He Jian Technology (Suzhou) Co. and handed a paltry $150,000 fine.

More than a decade ago, the Hsinchu-based company was charged with illegally investing in He Jian Technology (Suzhou) Co. and handed a paltry $150,000 fine.

Years later, a court overturned an initial guilty verdict.

That this case even dragged through the courts is a reflection of Taiwan’s weak legal structure and poorly worded regulations.

In 2009, UMC publicly bought a stake in He Jian in the ultimate show of disdain for Taiwan’s attempts to hold onto locally developed technology.

There’s every indication that UMC takes the Jinhua case just as seriously as it did He Jian (i.e., not very).

There’s every indication that UMC takes the Jinhua case just as seriously as it did He Jian (i.e., not very).

The company said it would halt R&D work for the Chinese client only this week, despite knowing of the case for over a year.

IP isn’t the only area of regulatory weakness.

IP isn’t the only area of regulatory weakness.

Mega Financial Holding Co. was handed a $180 million fine by New York State’s department of financial services in 2016 for money laundering after the regulator found that the bank's compliance program was a “hollow shell.”

At least six current and former Taiwanese cabinet members were subsequently investigated locally for their lax supervision of Taipei-based Mega.

Cybersecurity is another area of concern, one with global implications.

Cybersecurity is another area of concern, one with global implications.

The problem was highlighted when an old piece of malware caught out Taiwan Semiconductor Manufacturing Co., UMC’s bigger rival.

Ongoing attacks by China on local companies show there’s no room for complacency.

For years, Taiwanese authorities were ill-equipped and largely uninterested in combating the threat, with interference ahead of local elections finally giving the issue some overdue attention.

And let’s not forget insider trading.

And let’s not forget insider trading.

Taiwan is a known hub of industry gossip, tips and non-compliance.

Eight years ago, I spent months digging up details of its inside information ecosystem, with sources boasting to me about how much they knew and how easy it was to get away with trafficking in company secrets.

To the best of my knowledge, none of those people have been investigated by Taiwanese regulators.

So when a Taiwanese company gets charged with leaking U.S. secrets to a Chinese government-backed entity, the sad truth is that we’re not surprised – even though we should be.

Taiwan, and its government, has spent four decades and billions of dollars building its technological know-how.

So when a Taiwanese company gets charged with leaking U.S. secrets to a Chinese government-backed entity, the sad truth is that we’re not surprised – even though we should be.

Taiwan, and its government, has spent four decades and billions of dollars building its technological know-how.

That’s translated into trust on the part of Western companies that Taiwanese partners will keep their secrets.

With intellectual property at the heart of President Donald Trump’s trade war with China, Taiwan needs to show this hard-earned faith is still warranted.

With intellectual property at the heart of President Donald Trump’s trade war with China, Taiwan needs to show this hard-earned faith is still warranted.

In the past few months, numerous companies have indicated a willingness to move production out of China – and in some cases back to Taiwan – in response not only to U.S. security concerns, but also to rising costs and new tariffs.

If Taiwan, and its companies, can’t be trusted to safeguard confidential information then there’s little reason for global clients to keep giving them orders.

If Taiwan, and its companies, can’t be trusted to safeguard confidential information then there’s little reason for global clients to keep giving them orders.

Chinese companies are eager to take over, and its government is ready and willing to spend money to make that happen.

That makes Taiwan’s protection of intellectual property not just a political and security issue, but one of economic survival.

That makes Taiwan’s protection of intellectual property not just a political and security issue, but one of economic survival.

Aucun commentaire:

Enregistrer un commentaire