The Age

The Coalition government's proposed crackdown on Chinese manipulation of Australian public policy is welcome, if overdue, but its efficacy will be determined by details yet to be revealed, and it falls far short of the political donations reforms required to buttress public confidence in our democracy.

Democracy depends on transparency and accountability -- a carefully calibrated system of checks and balances that punish and deter undue influence, without placing undue shackles on political freedom and access to public debate.

The Age has long advocated comprehensive changes to political funding.

We cautiously endorse the mooted move to outlaw Chinese political donations and to create a public register of individuals and organisations representing the interests of Chinese government and corporations.

Beijing's stooge Sam Dastyari.

Beijing's stooge Sam Dastyari.

But the public will not have robust faith in the system until changes apparently excluded from the pending legislation are established.

Beijing's stooge Sam Dastyari.

Beijing's stooge Sam Dastyari.But the public will not have robust faith in the system until changes apparently excluded from the pending legislation are established.

These include: real-time public disclosure of donations; a cut in the disclosure threshold from $13,200 to $1000; capped donations from individuals, corporations and lobbyists; ending unions' compulsory donations to the ALP; and capping spending by parties.

To compensate for blocking murky private money, public funding should be augmented.

Further, Australia clearly needs a national anti-corruption commission, with full judicial powers.

Contemporary politics is replete with examples of opaque influence-seeking.

Contemporary politics is replete with examples of opaque influence-seeking.

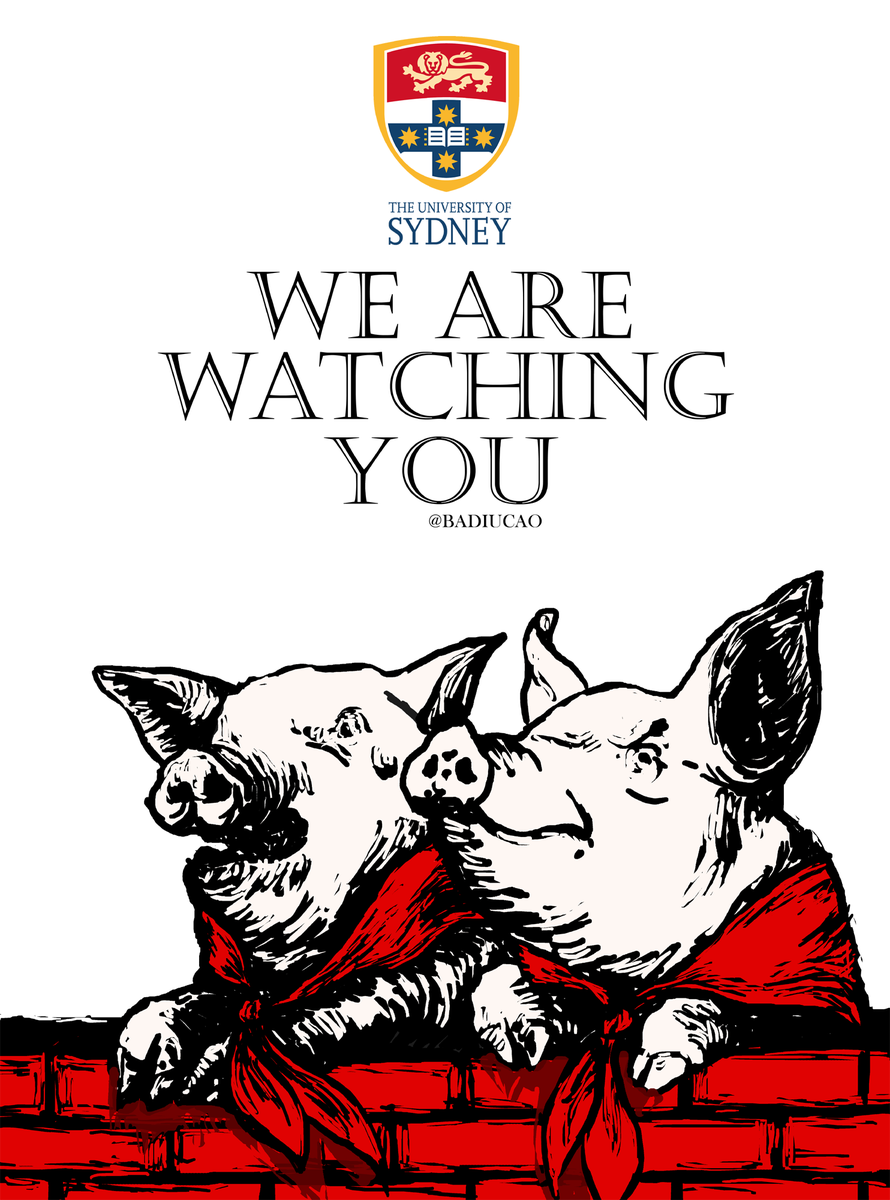

Labor Senator Sam Dastyari's complicity with Chinese interests is egregious to the point of disgraceful, and he arguably should resign from Parliament.

Former Liberal Party trade minister Andrew Robb's $880,000 annual stipend from the Chinese-government linked company that bought the port of Darwin is also unseemly.

His protestations that he is being unfairly labelled does not stand scrutiny.

The proposed legislation would require him to register as a Chinese agent.

Should he have nothing to hide, he should have no fear of transparency.

Senator Dastyari's behaviour, which included seeking and receiving Chinese money to cover personal expenses, while he advocated, in conflict with his own party's policy, for China's aggressive expansionism in the South China Sea, would, according to Attorney-General George Brandis, contravene the proposed law.

Senator Dastyari's behaviour, which included seeking and receiving Chinese money to cover personal expenses, while he advocated, in conflict with his own party's policy, for China's aggressive expansionism in the South China Sea, would, according to Attorney-General George Brandis, contravene the proposed law.

The Senator's warning to a Chinese donor about likely surveillance by Australia's security forces beggars belief.

The Liberal Party's receipt of hundreds of thousands of dollars from interests linked to the Chinese government is also evidence of the need to clean up political funding.

But it's not just Chinese influence that needs curbing.

But it's not just Chinese influence that needs curbing.

Former Liberal small business minister Bruce Billson's astounding failure to declare he was being paid by the $170-billion franchise industry's lobby group while still in federal parliament is appalling. Lobbyists are paid to influence lawmakers to tilt legislation in favour of the profitability of companies and/or the political power of foreign governments.

We need to examine whether the legislation has loopholes – for example, allowing Chinese entities to funnel money via locally registered organisations – or goes too far by, say, preventing charities from participating in public policy debate.

The law, should it pass, will inevitably be tested in the courts – one of the fundamental checks and balances of our democracy.