- Bloomberg survey of EU28 shows investment screening is coming

- Even those with reservations favor a debate on China strategy

By Lyubov Pronina, John Follain, and Slav Okov

Europe is set to tighten controls over foreign investment, a sign of growing wariness of China’s efforts to use its $11 trillion economy to become a dominant global power.

A Bloomberg survey of the European Union’s 28 member states found that at least 15 governments actively or tacitly support draft legislation that would screen investments from outside the bloc.

Europe is set to tighten controls over foreign investment, a sign of growing wariness of China’s efforts to use its $11 trillion economy to become a dominant global power.

A Bloomberg survey of the European Union’s 28 member states found that at least 15 governments actively or tacitly support draft legislation that would screen investments from outside the bloc.

With a majority prepared to wave it through, the proposal is on course for passage by the European Parliament, the bill’s next step to becoming law.

The results show that Europe is waking up to the risks and not just the benefits of inward investment, predominantly from China.

The results show that Europe is waking up to the risks and not just the benefits of inward investment, predominantly from China.

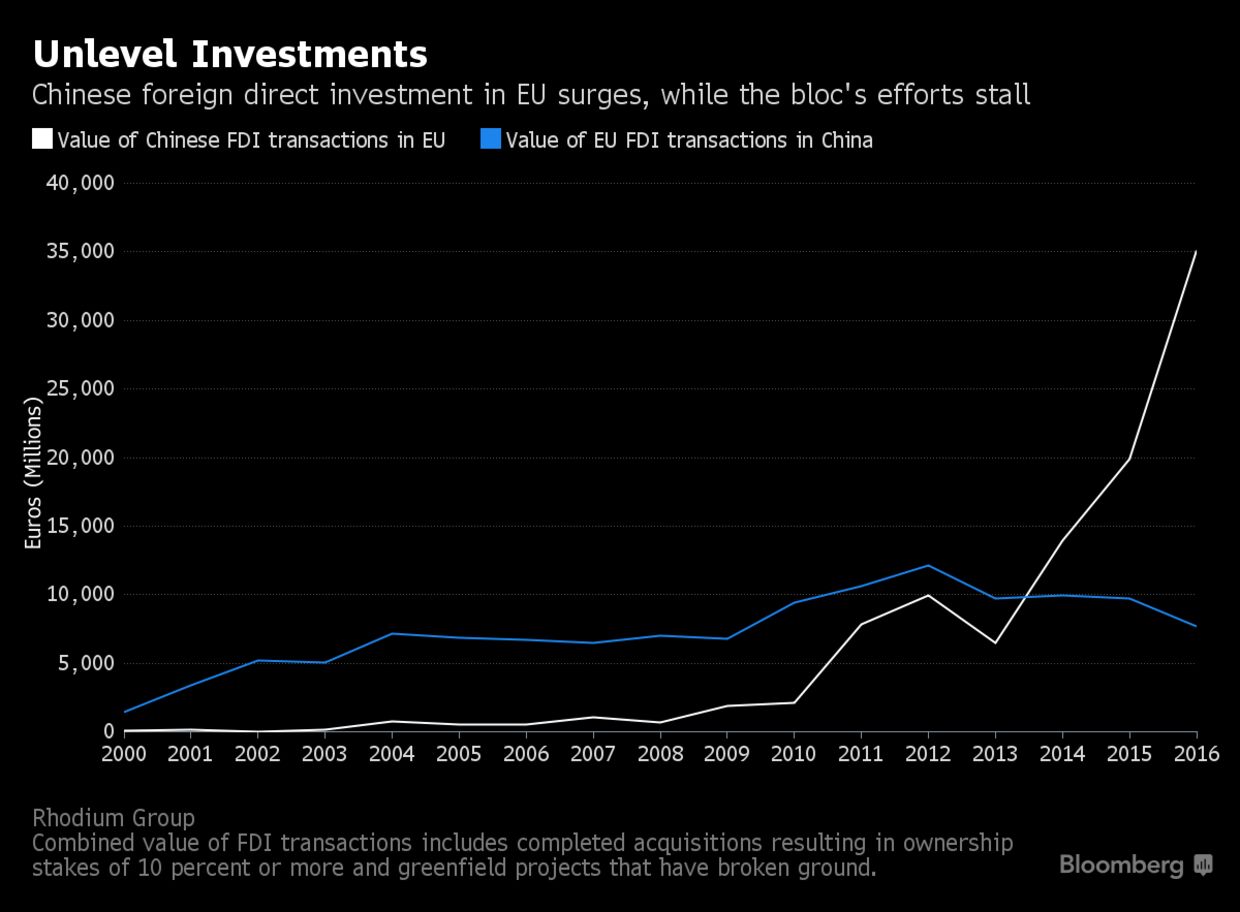

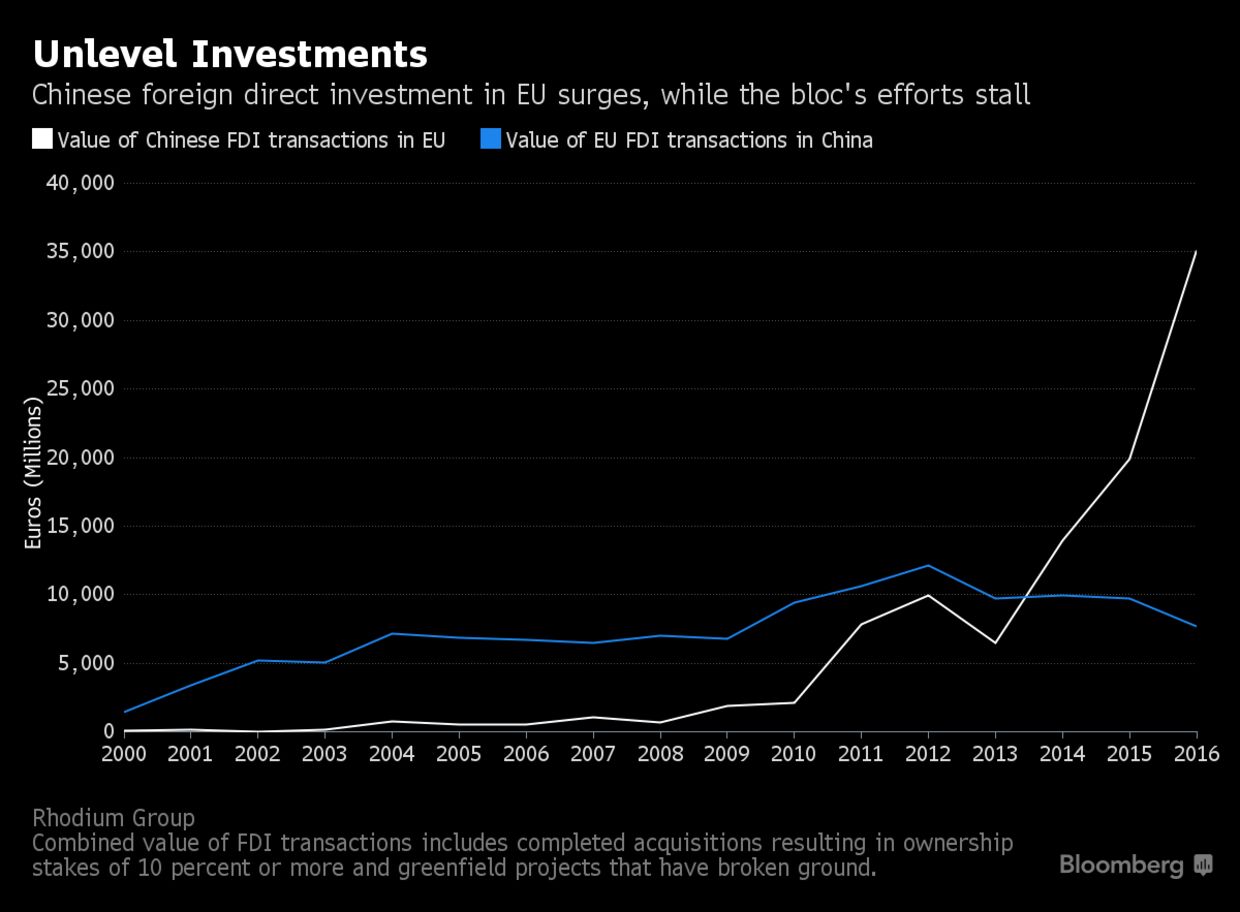

A Bloomberg audit found that China has invested at least $318 billion in Europe over the past decade, from critical infrastructure to high-tech companies -- more than in the U.S. over the same period.

Nine member states are fully behind the proposals and at least another six won’t oppose them, according to the survey

Europe’s pushback reflects a dilemma shared by governments worldwide as they grapple with China’s growing global clout.

Europe’s pushback reflects a dilemma shared by governments worldwide as they grapple with China’s growing global clout.

U.S. Treasury Secretary Steven Mnuchin is leading a delegation to Beijing this week amid disputes over trade, reciprocal market access and China’s state-driven economic model.

As the U.S., Japan and Australia adopt rigorous screening programs, Europe risks becoming “the shop of last resort” for those seeking advanced technologies, the European Council on Foreign Relations warned in a December report.

As the U.S., Japan and Australia adopt rigorous screening programs, Europe risks becoming “the shop of last resort” for those seeking advanced technologies, the European Council on Foreign Relations warned in a December report.

Taking Know-How

Italy is among those pushing for tighter screening “because we believe that trade must be fair and investment must be productive,” Sandro Gozi, Italy’s junior minister for European affairs, said in an interview.

“We have to assess whether investment by non-EU countries aims to do business, to promote growth, to create jobs in Europe, or whether it’s just aimed to acquire and then take the know-how of our businesses away from Europe.”

The EU proposal would create a centralized database of past foreign investments in Europe and an alert mechanism for future ones, leaving the ultimate power of approving deals with individual governments.

The EU proposal would create a centralized database of past foreign investments in Europe and an alert mechanism for future ones, leaving the ultimate power of approving deals with individual governments.

The EU Parliament’s international-trade committee, however, intends to vote on amendments that could give the bill more teeth.

After that, the spotlight will shift to the deliberations among EU governments.

For Bulgaria, which holds the EU’s rotating presidency, the proposal “is one of our trade policy priorities,” the Economy Ministry said in an emailed response to questions.

For Bulgaria, which holds the EU’s rotating presidency, the proposal “is one of our trade policy priorities,” the Economy Ministry said in an emailed response to questions.

The draft regulation doesn’t envisage obligatory screening, but rather “its purpose is to establish a mechanism for cooperation and coordination among member states” whereby countries applying screening should inform the others, it said.

Last year, when the EU first floated an investment screening mechanism, China called on the bloc to observe World Trade Organization rules and avoid discriminatory investment policies.

Last year, when the EU first floated an investment screening mechanism, China called on the bloc to observe World Trade Organization rules and avoid discriminatory investment policies.

It also says its signature Belt and Road infrastructure program benefits everyone, noting that leaders of most EU countries have expressed interest in signing up.

The survey revealed splits among governments, with countries such as Finland insisting the bloc avoid any resort to protectionist measures and others like Malta saying that small economies must remain open to investment.

The survey revealed splits among governments, with countries such as Finland insisting the bloc avoid any resort to protectionist measures and others like Malta saying that small economies must remain open to investment.

The U.K. and the Czech Republic were among those to stress that any curbs should be imposed at national level without recourse to the EU.

Yet all those surveyed welcomed the debate.

“There is a sea change of perception” toward China, said Francois Godemont, director of the Asia program at the European Council on Foreign Relations.

“There is a sea change of perception” toward China, said Francois Godemont, director of the Asia program at the European Council on Foreign Relations.

He cited a “wave of investments” for having fueled the shift, along with an inability of the EU and China to resolve their respective market issues to date.

In addition, he said, an awareness of political change in China including the removal of term limits has “soured the mood.”

All the same, the EU commission proposal “is already pretty much a compromise because it’s not legally binding,” Godemont said.

Europe’s approach is tame compared to President Donald Trump as he pushes his “America First” trade agenda, threatening protectionist barriers against allies and adversaries alike.

All the same, the EU commission proposal “is already pretty much a compromise because it’s not legally binding,” Godemont said.

Europe’s approach is tame compared to President Donald Trump as he pushes his “America First” trade agenda, threatening protectionist barriers against allies and adversaries alike.

The White House has said it would forge a “trade coalition of the willing” to stand up to China for unfair trade practices.

It’s also railed against China’s program to become the world leader in a slew of industries by 2025.

China’s global ambitions, including a push to dominate artificial intelligence, are causing consternation in Berlin and Paris: Chancellor Angela Merkel and President Emmanuel Macron have both made China’s rise a policy priority.

China’s global ambitions, including a push to dominate artificial intelligence, are causing consternation in Berlin and Paris: Chancellor Angela Merkel and President Emmanuel Macron have both made China’s rise a policy priority.

Macron has pledged to seek more strategic coordination with Germany on the issue.

Merkel plans her own visit to China later this year.

Even EU state traditionally more skeptical of a bloc-wide policy approach are paying heed.

Hungary is ready to debate investment screening so long as it doesn’t result in different standards among EU members, Gergely Gulyas, vice president and parliamentary leader of Hungary’s ruling Fidesz party, said in an interview.

“If we have a common China policy, we are ready to be part of it,” he said.

Even EU state traditionally more skeptical of a bloc-wide policy approach are paying heed.

Hungary is ready to debate investment screening so long as it doesn’t result in different standards among EU members, Gergely Gulyas, vice president and parliamentary leader of Hungary’s ruling Fidesz party, said in an interview.

“If we have a common China policy, we are ready to be part of it,” he said.

Aucun commentaire:

Enregistrer un commentaire