By He Huifeng and Laura Zhou

For Chinese residents of Venezuela who fled that country’s chaos, a new International Monetary Fund inflation outlook dampens their hopes of returning to retrieve assets.

For Chinese residents of Venezuela who fled that country’s chaos, a new International Monetary Fund inflation outlook dampens their hopes of returning to retrieve assets.

For Chinese residents of Venezuela who fled that country’s chaos, a new International Monetary Fund inflation outlook dampens their hopes of returning to retrieve assets.

For Chinese residents of Venezuela who fled that country’s chaos, a new International Monetary Fund inflation outlook dampens their hopes of returning to retrieve assets.

The International Monetary Fund’s forecast of 2,349 per cent inflation for Venezuela in 2018, up from an estimated 2,069 per cent this year, is a rude reminder for China – the Latin American country’s key foreign creditor – about the risks of overseas investment, analysts said.

China has showered the oil-dependent nation of 30 million people with more than US$60 billion in loans, backed by oil supply deals and other contracts and investments.

China has showered the oil-dependent nation of 30 million people with more than US$60 billion in loans, backed by oil supply deals and other contracts and investments.

China Development Bank (CDB), a state lender, alone has poured at least US$37 billion into the country in the last decade.

But China has little leverage to protect its interests as economic and social conditions in Venezuela worsen.

China has little leverage to protect its interests as economic and social conditions in Venezuela worsen, sparking demonstrations against the government of Venezuelan President Nicolas Maduro.

China has little leverage to protect its interests as economic and social conditions in Venezuela worsen, sparking demonstrations against the government of Venezuelan President Nicolas Maduro.

But China has little leverage to protect its interests as economic and social conditions in Venezuela worsen.

China has little leverage to protect its interests as economic and social conditions in Venezuela worsen, sparking demonstrations against the government of Venezuelan President Nicolas Maduro.

China has little leverage to protect its interests as economic and social conditions in Venezuela worsen, sparking demonstrations against the government of Venezuelan President Nicolas Maduro.

Huo Jianguo, a vice-chairman of the China Society for the World Trade Organisation Studies, a think-tank affiliated with the Ministry of Commerce, said the IMF’s forecast should teach China to be more careful with its outbound investment.

“It’s a reminder that China must study a country’s risks carefully and make proper plans [before investing there],” Huo said.

“It’s a reminder that China must study a country’s risks carefully and make proper plans [before investing there],” Huo said.

“Otherwise, similar situations may happen again and again. China is still in the learning process in overseas investment.”

For Venezuela’s Chinese residents who fled the country’s chaos, the IMF’s forecasts dampen their hopes of one day returning to retrieve assets.

The four-digit inflation rate will put the country into a long period of turmoil, and China-led projects put on hold will be severely challenged to be re-started, said Mey Hou, whose small family-owned building-materials supply business in Caracas provides sand, stone and cement to Chinese state enterprises for local infrastructure and property projects.

Hou, now living in Guangdong province’s Enping county, said most Chinese investors and workers in Venezuela had left the country.

Mingli Zhong, who lived in Venezuela for two decades before returning to Enping earlier this year, said he was not shocked by the IMF’s prediction.

“A three-digit annual inflation rate is not much different from four-digit one … they both mean Venezuelan bolívars are just waste paper,” he said.

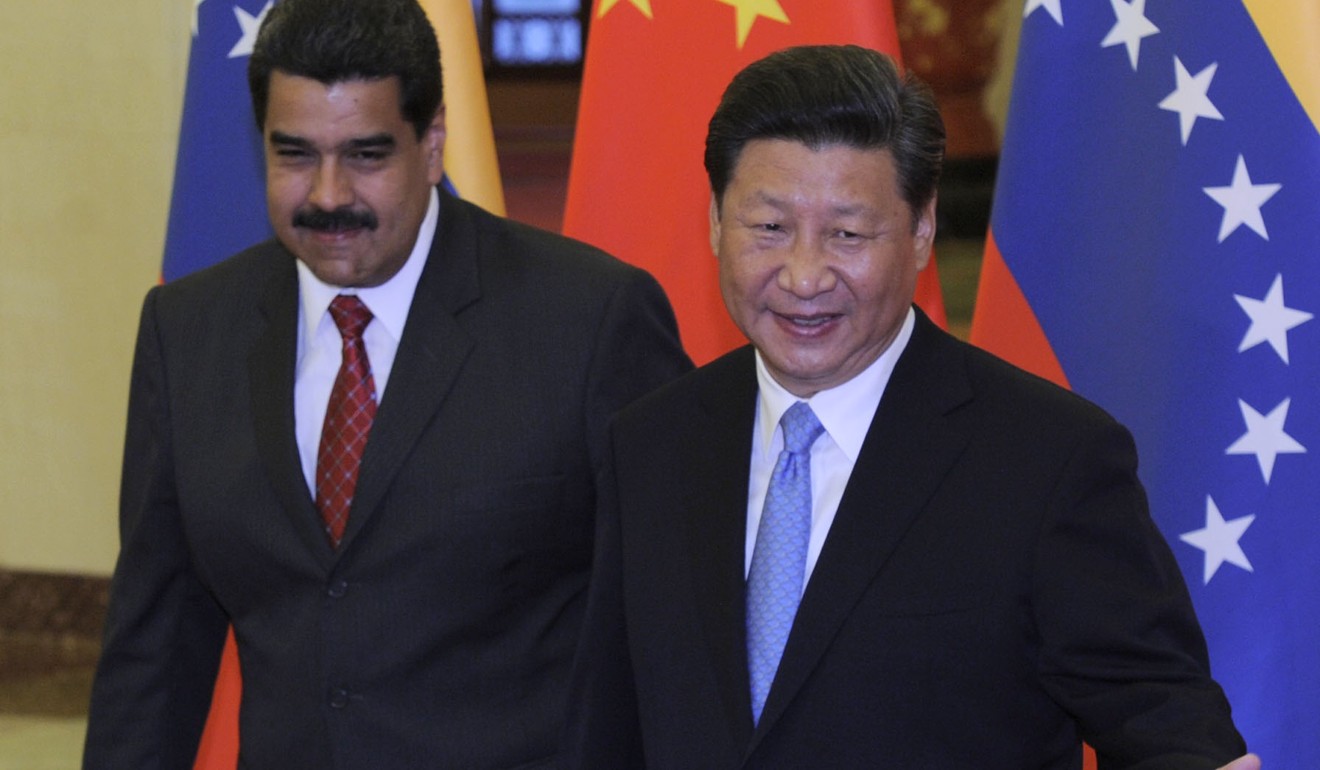

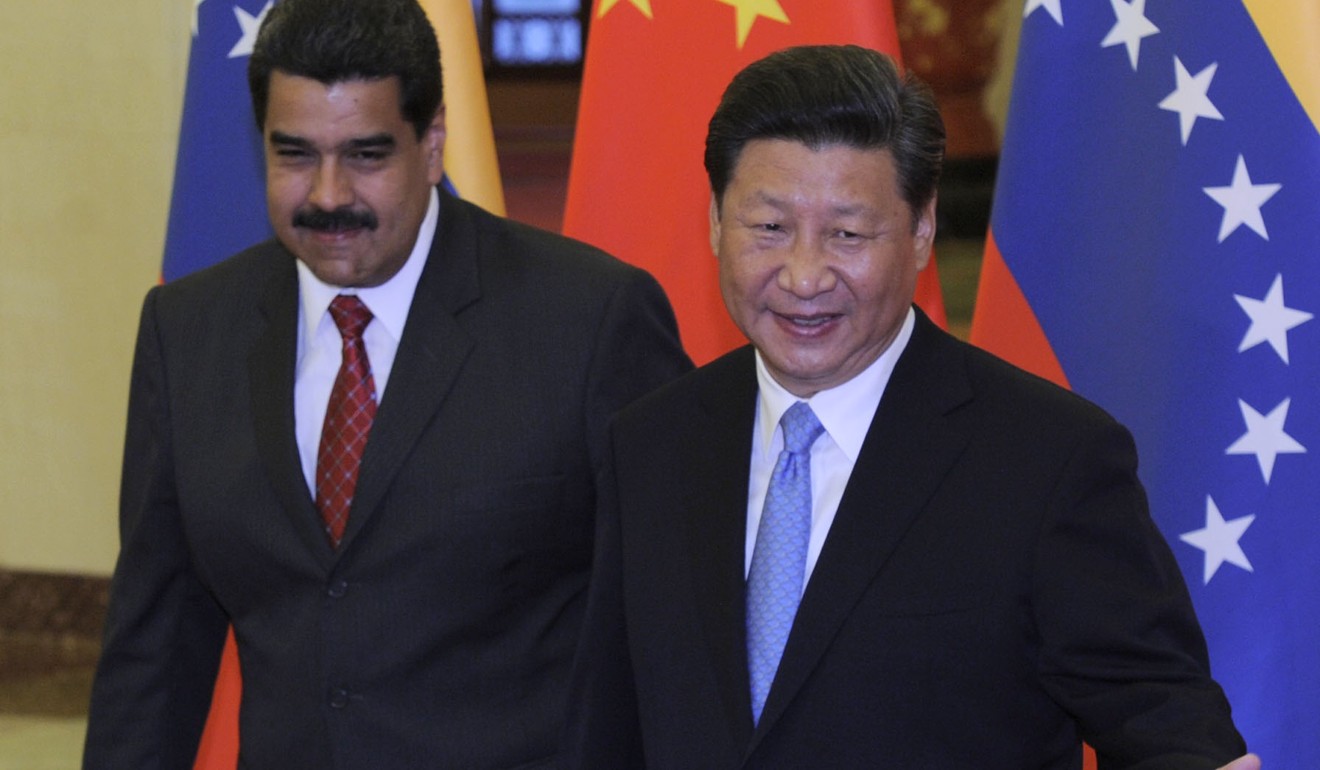

The Dirty Two: Nicolas Maduro (left) has looked to relations with Xi Jinping for investment to halt the Latin American country’s economic turmoil.

The Dirty Two: Nicolas Maduro (left) has looked to relations with Xi Jinping for investment to halt the Latin American country’s economic turmoil.

For Venezuela’s Chinese residents who fled the country’s chaos, the IMF’s forecasts dampen their hopes of one day returning to retrieve assets.

The four-digit inflation rate will put the country into a long period of turmoil, and China-led projects put on hold will be severely challenged to be re-started, said Mey Hou, whose small family-owned building-materials supply business in Caracas provides sand, stone and cement to Chinese state enterprises for local infrastructure and property projects.

Hou, now living in Guangdong province’s Enping county, said most Chinese investors and workers in Venezuela had left the country.

Mingli Zhong, who lived in Venezuela for two decades before returning to Enping earlier this year, said he was not shocked by the IMF’s prediction.

“A three-digit annual inflation rate is not much different from four-digit one … they both mean Venezuelan bolívars are just waste paper,” he said.

The Dirty Two: Nicolas Maduro (left) has looked to relations with Xi Jinping for investment to halt the Latin American country’s economic turmoil.

The Dirty Two: Nicolas Maduro (left) has looked to relations with Xi Jinping for investment to halt the Latin American country’s economic turmoil.

“Many ethnic Chinese living in Venezuela bought properties there,” he said.

“The buildings once priced at a few hundred thousands in US dollars or even more. But now they worth nothing.”

Venezuela’s central bank stopped publishing inflation data in December 2015 after prices spiralled out of control.

The IMF’s Venezuela inflation forecasts are widely reported by Chinese online media, attracting far greater interest among Chinese readers, for instance, than the IMF’s raising China’s 2017 growth forecast to 6.8 per cent from 6.7 per cent.

Venezuela’s central bank stopped publishing inflation data in December 2015 after prices spiralled out of control.

The IMF’s Venezuela inflation forecasts are widely reported by Chinese online media, attracting far greater interest among Chinese readers, for instance, than the IMF’s raising China’s 2017 growth forecast to 6.8 per cent from 6.7 per cent.

On popular news portal NetEase, the report about Venezuela’s inflation rate attracted more than 10,000 comments; in contrast, the report on the IMF’s revised China GDP forecast generated just one comment.

China has showered Venezuela with loans backed by myriad deals. Xi Jinping (centre) is shown at the signing ceremony for an agreement that tied energy-hungry China to oil-rich Venezuela.

China has showered Venezuela with loans backed by myriad deals. Xi Jinping (centre) is shown at the signing ceremony for an agreement that tied energy-hungry China to oil-rich Venezuela.

China has showered Venezuela with loans backed by myriad deals. Xi Jinping (centre) is shown at the signing ceremony for an agreement that tied energy-hungry China to oil-rich Venezuela.

China has showered Venezuela with loans backed by myriad deals. Xi Jinping (centre) is shown at the signing ceremony for an agreement that tied energy-hungry China to oil-rich Venezuela.

“How can one expect Venezuela to repay its debt [with such a high inflation]?” one comment read.

Chu Yin, an associate professor at the University of International Relations in Beijing, said it was too early to call China’s financial support to Venezuela a failure because Venezuela could still repay China’s loans with oil.

“Venezuela is on brink of collapse, but it has not collapsed – the army is still listening to the government,” Chu said.

Chu Yin, an associate professor at the University of International Relations in Beijing, said it was too early to call China’s financial support to Venezuela a failure because Venezuela could still repay China’s loans with oil.

“Venezuela is on brink of collapse, but it has not collapsed – the army is still listening to the government,” Chu said.

Aucun commentaire:

Enregistrer un commentaire