- President Trump is creating a new economic world order in his China trade war, says economist Mohamed El-Erian.

- “We win a relative trade war. In absolute terms we suffer. But we win relative to others,” says El-Erian.

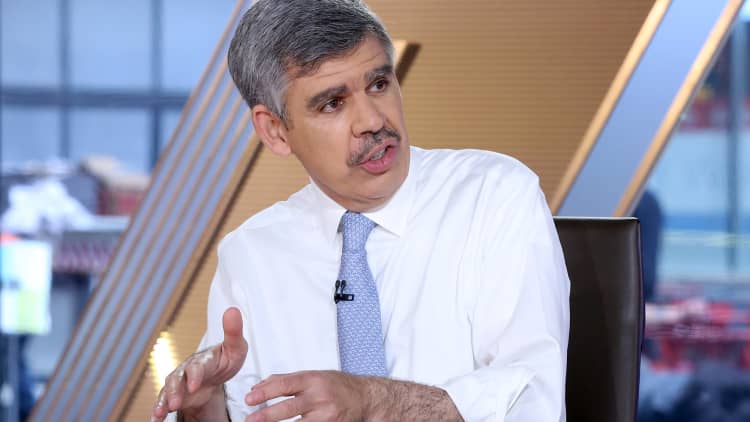

Mohamed El-Erian says US wins the trade war

President Donald Trump stands a chance of creating a new economic world order in his fight with China over unfair trade practices, American intellectual property theft and cyberspying, economist Mohamed El-Erian said on CNBC Monday.

“I think we should not underestimate something ‘Reaganesque,’” said El-Erian, chief economic advisor of Allianz, likening the current situation to how former President Ronald Reagan was able to change the global geopolitical landscape after winning the Cold War against Russia.

As El-Erian spoke in a “Squawk Box” interview, U.S.-China trade talks have stalled, and the two nations have stepped up tariffs on each other’s imports.

In addition, the U.S. has effectively blacklisted Chinese telecom giant Huawei on national security concerns. (Alphabet’s Google followed the Trump administration’s lead and suspended business with Huawei.)

El-Erian has handicapped three scenarios, listing the chances of a “short-term” trade deal between the U.S. and China at 65%, a “Reagan moment” at 15%, and a full-blown trade war at 20%.

“I think what you’re seeing is the status quo is coming down. And the possibility of the other two are going up,” he said.

El-Erian has handicapped three scenarios, listing the chances of a “short-term” trade deal between the U.S. and China at 65%, a “Reagan moment” at 15%, and a full-blown trade war at 20%.

“I think what you’re seeing is the status quo is coming down. And the possibility of the other two are going up,” he said.

“If the U.S. goes full-blown with this as about national security, it can actually change the economic dynamics on a global scale. It really can.”

No matter the resolution, it won’t come quickly, and Wall Street is going to have to deal with the uncertainty in the meantime, he added.

However, El-Erian said the U.S. stock market is better positioned to weather the trade storm than are Chinese equities.

“We win a relative trade war. In absolute terms we suffer. But we win relative to others, ” he said.

No matter the resolution, it won’t come quickly, and Wall Street is going to have to deal with the uncertainty in the meantime, he added.

However, El-Erian said the U.S. stock market is better positioned to weather the trade storm than are Chinese equities.

“We win a relative trade war. In absolute terms we suffer. But we win relative to others, ” he said.

“I think the markets have understood that the U.S. is in a better place than the rest of the world.”

As of Friday’s close, which marked two straight weekly losses for the S&P 500, the broad-based measure of the U.S. stock market had still surged about 14% this year.

As of Friday’s close, which marked two straight weekly losses for the S&P 500, the broad-based measure of the U.S. stock market had still surged about 14% this year.

Despite all the recent trade-induced turmoil, the index was only about 3% off record high close on April 30.

Chinese stocks in the Shanghai Stock Exchange Composite Index have lost about 10% in 2019.

“The realization in the U.S. is that this is the time. If not now, when?” he said.

“The realization in the U.S. is that this is the time. If not now, when?” he said.

Aucun commentaire:

Enregistrer un commentaire