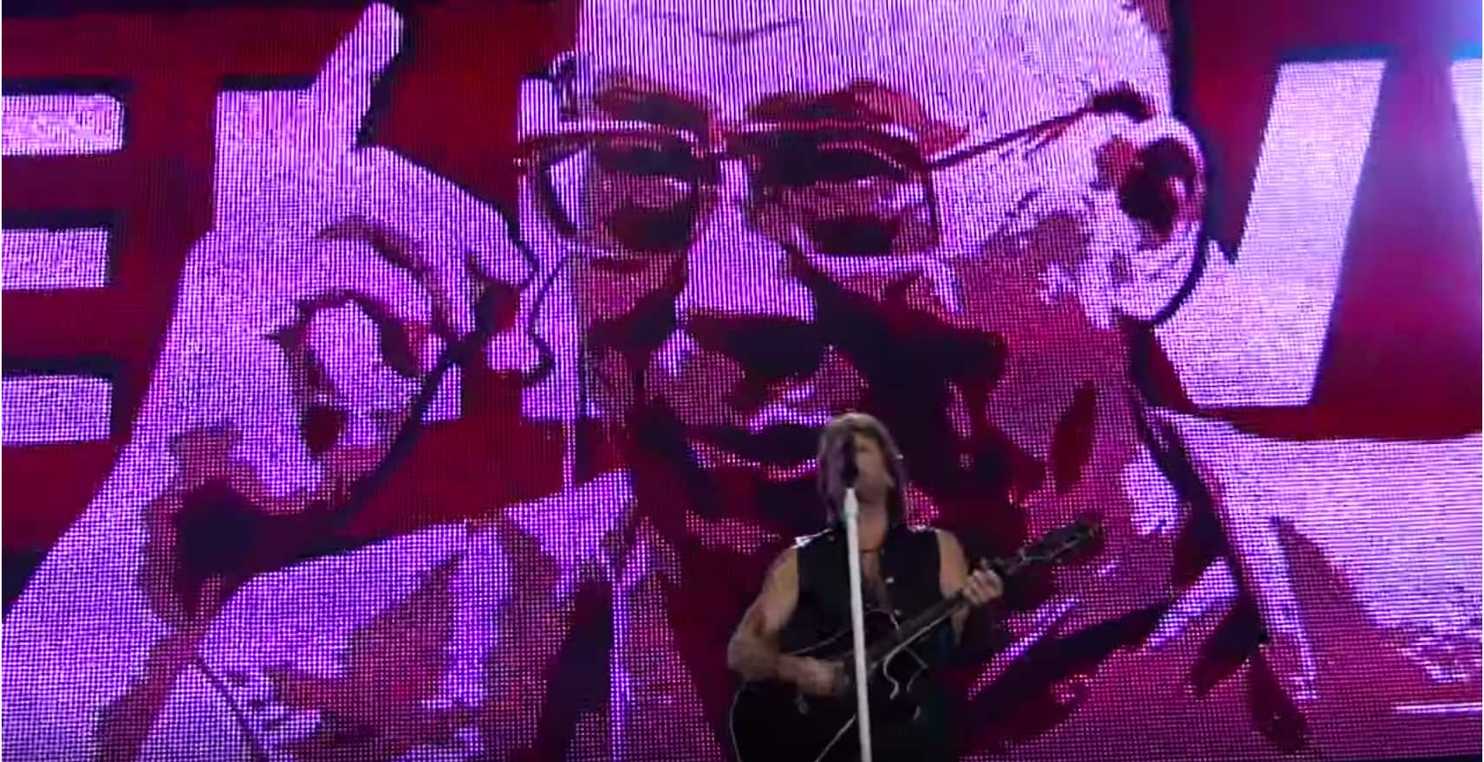

Journalist Ann Curry, the Dalai Lama, Lady Gaga and Philip Anschutz at the U.S. Conference of Mayors in Indianapolis in June.

Journalist Ann Curry, the Dalai Lama, Lady Gaga and Philip Anschutz at the U.S. Conference of Mayors in Indianapolis in June.A week before American rock band Bon Jovi was set to play its first-ever concerts in mainland China last year, the shows were abruptly canceled.

The promoter, AEG Live—a subsidiary of Los Angeles-based Anschutz Entertainment Group, controlled by reclusive mogul Philip Anschutz—didn’t offer any public explanation for the cancellations.

Press reports at the time, citing anonymous sources, blamed the band’s performance a few years earlier in front of an image of the Dalai Lama that led to the Chinese government revoking the permit for concerts in Beijing and Shanghai.

Left out of those contemporary accounts was who had circulated the image to begin with, and why.

People close to AEG spread the clip in hopes the Chinese government would force them to cancel, according to people with knowledge of the episode.

Left out of those contemporary accounts was who had circulated the image to begin with, and why.

People close to AEG spread the clip in hopes the Chinese government would force them to cancel, according to people with knowledge of the episode.

The promoter deliberately provoked China’s ire, they said, because ticket sales were so soft that company executives worried they would lose money if they went ahead with the shows.

Bon Jovi stood to earn more than $4 million if the China shows had taken place, according to a person familiar with the matter; instead, this person added, AEG paid the band less than $1 million after invoking a “force majeure,” or act of God, clause, because Chinese officials had canceled the concerts.

Jay Marciano, chairman of AEG Live and chief operating officer of AEG, dismisses that account. “It’s an absurd notion that AEG would ever involve a government agency in order to mitigate a show loss. Our relationships with talent are too important, especially with Bon Jovi,” he said, adding that the company had promoted the band’s shows for more than a decade.

A representative for Bon Jovi said the band was “alerted only that the permits had been revoked” and had no knowledge of who had circulated the video.

The incident underscores the challenges one of the world’s largest concert promoters faces in China, a market that has proven difficult for foreign entertainment companies to crack amid an economic slowdown, tight government controls and fickle consumer tastes.

Frustrated with its lack of traction since entering mainland China a decade ago, AEG has been shifting its focus to other Asian markets including Singapore, Macau and Seoul, according to people familiar with the matter, while seeking a new strategic partner in China to help get its business there back on track.

Bon Jovi stood to earn more than $4 million if the China shows had taken place, according to a person familiar with the matter; instead, this person added, AEG paid the band less than $1 million after invoking a “force majeure,” or act of God, clause, because Chinese officials had canceled the concerts.

Jay Marciano, chairman of AEG Live and chief operating officer of AEG, dismisses that account. “It’s an absurd notion that AEG would ever involve a government agency in order to mitigate a show loss. Our relationships with talent are too important, especially with Bon Jovi,” he said, adding that the company had promoted the band’s shows for more than a decade.

A representative for Bon Jovi said the band was “alerted only that the permits had been revoked” and had no knowledge of who had circulated the video.

The incident underscores the challenges one of the world’s largest concert promoters faces in China, a market that has proven difficult for foreign entertainment companies to crack amid an economic slowdown, tight government controls and fickle consumer tastes.

Frustrated with its lack of traction since entering mainland China a decade ago, AEG has been shifting its focus to other Asian markets including Singapore, Macau and Seoul, according to people familiar with the matter, while seeking a new strategic partner in China to help get its business there back on track.

Mr. Marciano said “in no way are we looking to divest our assets in China” but rather are seeking partners that could create “new opportunities.”

AEG manages two arenas in China: The Mercedes-Benz Arena in Shanghai has been successful, while the Damai Center in Dalian, a commercial hub in northeastern China, has not developed as quickly as expected.

AEG manages two arenas in China: The Mercedes-Benz Arena in Shanghai has been successful, while the Damai Center in Dalian, a commercial hub in northeastern China, has not developed as quickly as expected.

Potential investors such as Alibaba Group Holding Ltd. ’s Alisports division aren’t interested in investing in only the Dalian venue, people familiar with the matter said, but would insist on taking a stake in the better-performing Shanghai venue’s management, too.

John Cappo, AEG China’s chief executive, said the company has been speaking with “various strategic partners,” but declined to comment on whether it is talking with Alisports about investing in its China arena operations.

Alisports, in a written response, said that it has had “casual exchanges” with AEG on investment in its China assets, but no concrete progress has been made.

AEG is making money in China, according to people familiar with the matter, but has faced conflicts with business partners over arena operations and a government anticorruption campaign that has eaten into ticket sales.

While China is “challenging for any company,” according to Mr. Cappo, the 18,000-seat Mercedes-Benz Arena in Shanghai—which has hosted Western acts such as Taylor Swift and the Rolling Stones—is “not only the most successful venue in China, but the most successful venue in Asia.”

AEG owns or operates more than 100 venues—and in some cases the surrounding real estate—around the world, while promoting concerts through its AEG Live division.

John Cappo, AEG China’s chief executive, said the company has been speaking with “various strategic partners,” but declined to comment on whether it is talking with Alisports about investing in its China arena operations.

Alisports, in a written response, said that it has had “casual exchanges” with AEG on investment in its China assets, but no concrete progress has been made.

AEG is making money in China, according to people familiar with the matter, but has faced conflicts with business partners over arena operations and a government anticorruption campaign that has eaten into ticket sales.

While China is “challenging for any company,” according to Mr. Cappo, the 18,000-seat Mercedes-Benz Arena in Shanghai—which has hosted Western acts such as Taylor Swift and the Rolling Stones—is “not only the most successful venue in China, but the most successful venue in Asia.”

AEG owns or operates more than 100 venues—and in some cases the surrounding real estate—around the world, while promoting concerts through its AEG Live division.

Its ambitions were likewise grand for China when it entered the market in 2008.

Company management at the time hoped to invest $100 million to develop and run a dozen arenas throughout China that would host large-scale concerts and sports events.

Now, though, after investing around $50 million, according to people familiar with the matter, AEG manages only the Shanghai and Dalian arenas, and consults on a Beijing arena.

Now, though, after investing around $50 million, according to people familiar with the matter, AEG manages only the Shanghai and Dalian arenas, and consults on a Beijing arena.

It has realized that Shanghai is its primary market in China, given the city’s commercial vibe and unique interest in Western entertainment, these people said.

In Dalian, ticket-buying culture has been slower to catch on, Mr. Cappo said.

While AEG’s China team is negotiating with partners on projects in the cities of Chengdu, Hangzhou and Chongqing, AEG’s top management is reluctant to expand its China footprint due to the slow growth and is looking to other Asian markets offering faster growth and fewer challenges, they added.

There were other reasons AEG’s traditional model didn’t work as hoped.

In China, entertainment and sports arenas, like other parts of the country’s entertainment industry, are strictly regulated by the government.

While AEG’s China team is negotiating with partners on projects in the cities of Chengdu, Hangzhou and Chongqing, AEG’s top management is reluctant to expand its China footprint due to the slow growth and is looking to other Asian markets offering faster growth and fewer challenges, they added.

There were other reasons AEG’s traditional model didn’t work as hoped.

In China, entertainment and sports arenas, like other parts of the country’s entertainment industry, are strictly regulated by the government.

Because AEG manages—rather than owns—arenas in China, its expansion into key cities relies on its relationships with these venue operators, mostly state-backed companies.

The danger is that, “as soon as you show your partners how to do something, they want to do it themselves,” said a person familiar with AEG’s China operations.

The danger is that, “as soon as you show your partners how to do something, they want to do it themselves,” said a person familiar with AEG’s China operations.

“Operating arenas isn’t the most complicated thing in the world.”

In June, Mr. Anschutz, who insiders say has been anxious to recoup his investments in China, was photographed with the Dalai Lama at a conference of U.S. mayors in Indianapolis.

AEG declined to comment.

In June, Mr. Anschutz, who insiders say has been anxious to recoup his investments in China, was photographed with the Dalai Lama at a conference of U.S. mayors in Indianapolis.

AEG declined to comment.

Aucun commentaire:

Enregistrer un commentaire