Bloomberg News

The yuan slipped to a six-year low as concern about China’s trade relationship with a more protectionist U.S. provided a new reason to sell the currency that’s heading for a third annual loss.

The exchange rate fell 0.21 percent to 6.7923 per dollar at 5:13 p.m. in Shanghai, heading for its lowest closing level since September 2010, and extending its drop this year to 4.4 percent.

China’s central bank barely weakened its yuan fixing even after a 1.4 percent surge by the Bloomberg Dollar Spot Index on Wednesday, helping the Asian currency rally against a basket of peers.

Trump has called China a "grand master" at currency manipulation and has threatened tariffs of up to 45 percent on the country’s imports, a step that Commonwealth Bank of Australia estimated would cut China’s shipments to the U.S. by 25 percent in the first year.

Trump has called China a "grand master" at currency manipulation and has threatened tariffs of up to 45 percent on the country’s imports, a step that Commonwealth Bank of Australia estimated would cut China’s shipments to the U.S. by 25 percent in the first year.

Speculation Trump would unleash a wave of spending, triggering a surge in inflation, is prompting traders to boost bets on higher U.S. borrowing costs.

"The yuan may be pressured by Trump’s win," said Nathan Chow, an economist at DBS Group Holdings Ltd. in Hong Kong.

"The yuan may be pressured by Trump’s win," said Nathan Chow, an economist at DBS Group Holdings Ltd. in Hong Kong.

"There’s speculation that he could add punitive measures that hurt China’s exports, and also he may favor higher U.S. interest rates."

The yuan jumped the most against a basket of peers since July after the People’s Bank of China cut its daily reference rate by just 0.08 percent.

The yuan jumped the most against a basket of peers since July after the People’s Bank of China cut its daily reference rate by just 0.08 percent.

The fixing was stronger than expected, suggesting China wants to curb declines in the yuan, said Ken Cheung, a Hong Kong-based Asia currency strategist at Mizuho Bank Ltd.

Trump will probably follow through with his pledge to declare China a currency manipulator on his first day in office, according to Lewis Alexander, a former Federal Reserve and U.S. Treasury official.

Trump will probably follow through with his pledge to declare China a currency manipulator on his first day in office, according to Lewis Alexander, a former Federal Reserve and U.S. Treasury official.

Trump, who staged a stunning upset in the Nov. 8 U.S. vote, said since the beginning of his campaign that China keeps the yuan artificially weak against the dollar to make its exports more competitive, at the expense of manufacturing jobs in the U.S.

"Trump has made his stance quite clear about China and it is definitely not a friendly outcome in terms of bilateral trade relations," said Christy Tan, head of markets strategy in Hong Kong at National Australia Bank Ltd.

China Central Television on Wednesday cited Xi Jinping as saying that he "hopes" to work with Trump to expand bilateral cooperation.

"Trump has made his stance quite clear about China and it is definitely not a friendly outcome in terms of bilateral trade relations," said Christy Tan, head of markets strategy in Hong Kong at National Australia Bank Ltd.

China Central Television on Wednesday cited Xi Jinping as saying that he "hopes" to work with Trump to expand bilateral cooperation.

He also said he hoped the two stick to the principles of avoiding any conflicts or confrontations.

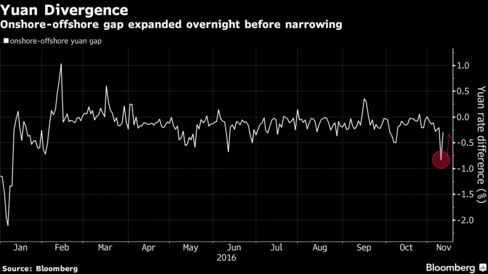

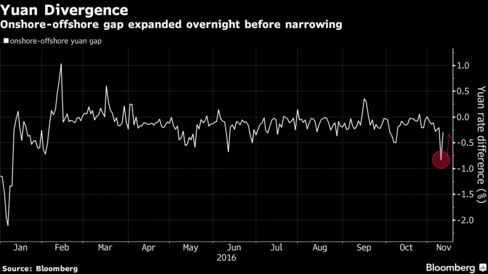

The gap between the onshore yuan and the freely traded yuan in Hong Kong widened to more than 0.5 percent overnight, the biggest since the start of the year.

The gap between the onshore yuan and the freely traded yuan in Hong Kong widened to more than 0.5 percent overnight, the biggest since the start of the year.

The offshore rate gained 0.21 percent on Thursday after tumbling as much as 0.6 percent on Wednesday following Trump’s victory.

Aucun commentaire:

Enregistrer un commentaire